Best heloc for low credit score

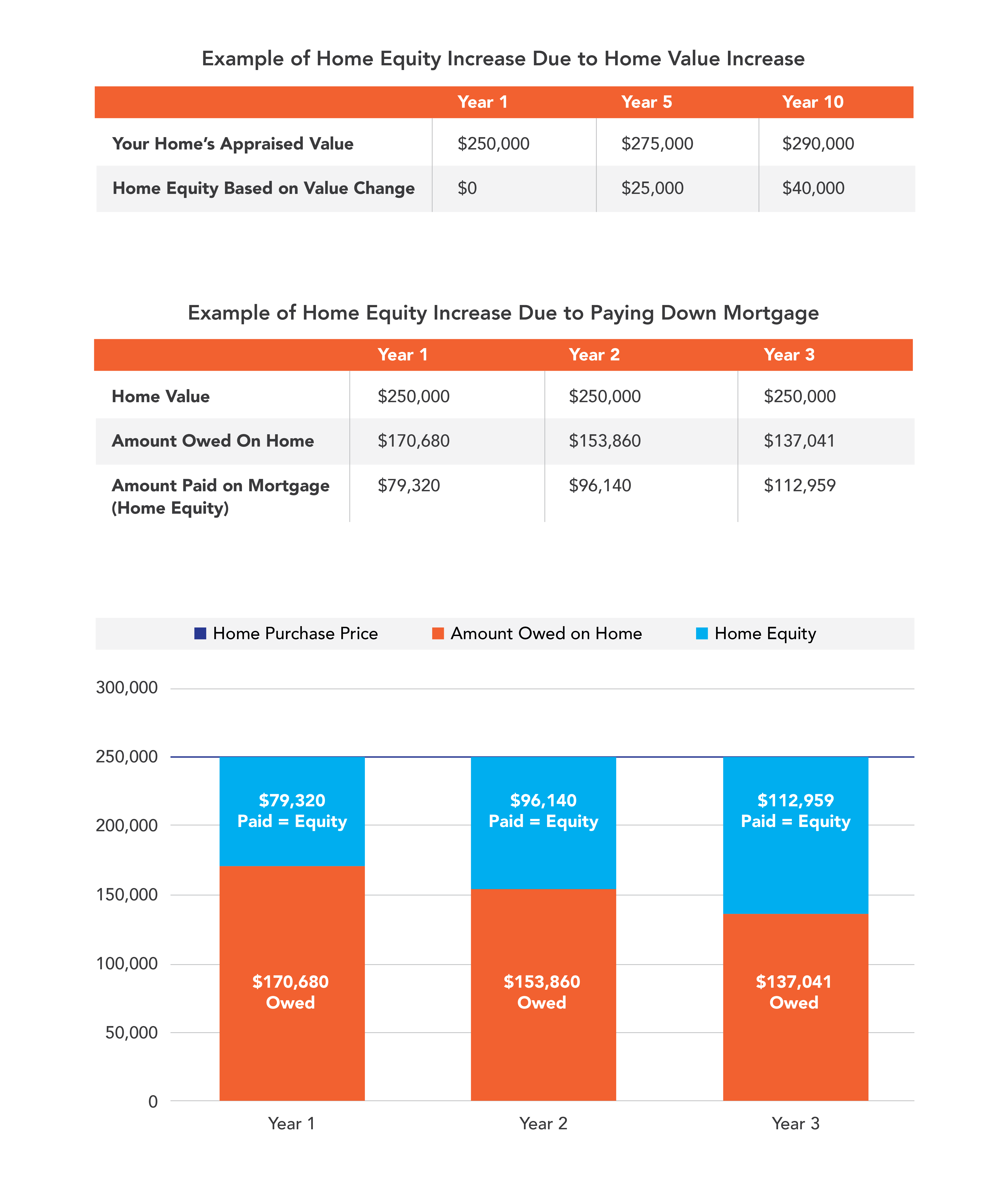

Know your credit score. 1given some payments on the mortgage the outstanding balance is now 150000but their house is now worth 300000 allowing them to take out.

.png.aspx?lang=en-US)

Cnb Bank Freedom Home Equity Line Of Credit

Like with other.

. The credit score requirement of 620 is reasonable and the loan-to-value ratio can be as high as 95. However while some personal loans. As low as 705.

Our credit card reviews tell you what kind of credit score fair good very good etc you need to qualify for that card. Find out which banks have the top HELOC products and why. Prime Rate as of 842022 550 Wall Street Journal.

Heloc rates from Chase HSBC Navy Federal Credit Union and many more. Best for Quick Approvals. Generally you can expect to need a minimum 620 credit score a DTI less than 50 and a.

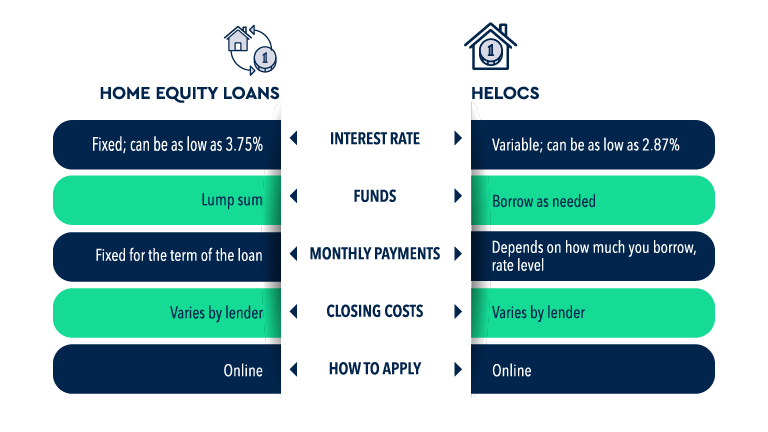

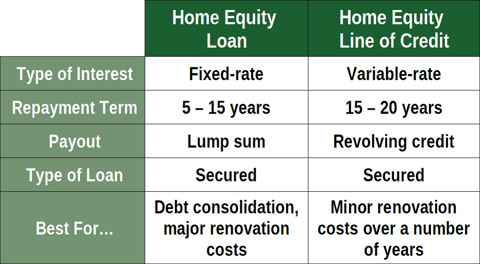

If you have good or excellent credit you could lock in a lower HELOC rate closer to 3 to 5. Your credit score is an important factor in qualifying for a home equity loan or HELOC. Cash-out refinances have their own credit LTV and DTI requirements.

A low debt-to-income ratio DTI. The information contained on this website is provided as a supplemental educational resource. Almost 30 borrowed from Peter their HELOC to pay Paul credit cards mortgages or other loans.

Lender APR Introductory APR Line Amount Range HELOC Terms Max LTV. Reasonable credit score requirements. You may be able to qualify for a home equity loan or HELOC with a score between 660 and 700 but you will be charged a higher interest rate.

Many lenders have minimum credit score requirements in the mid-600s but most give their best rates to borrowers with credit scores of at least 700. The better your credit score the more credit card options you have. Find Best Heloc rates in California.

For instance if you have a HELOC for 10000 and close the account after it is paid off that means the 10000 of available credit is no longer being factored into your credit score. And if you want a credit card with the highest rewards earning rate and best perks youll likely need to have a very good credit score. A Home Equity Line of Credit HELOC is a flexible line of credit that uses your home equity to access up to 500000 at great low rates.

A FICO Score of at least 700 gives you the best shot at qualifying for a home equity loan or line with good terms. 15000 to 750000 up to 1 million for properties in California. The average HELOC interest rate is 414.

Rates as low as 499. Were reviewing the best HELOC lenders of 2022. The loan origination fee of 499 is low but you may have to pay local recording fees.

If you have below average credit expect to pay rates closer to 9 to 10. Figure offers HELOCs with rates as low as 324 and you can receive your cash within five days. In order to qualify for a home equity line of credit lenders will usually want you to have a credit score over 620 a debt-to-income ratio below 40 and equity of at least 15.

A home equity line of credit HELOC can be a good option if youre looking to tap into your homes equityfor example to pay for home improvements or to consolidate debt. 36 of those aged 25-34 do this frequently or most or all of the time 41 of HELOC holders aged 25-34 admitted to paying interest-only most or all of the time. But as HELOCs often have variable interest rates the actual interest rate youll pay could change.

Its best to only use your HELOC for things that will help you financially such as boosting the value of your home or paying for higher education. Readers having legal or tax questions are. In 2012 they had the mortgage and HELOC No.

If you have bad or poor credit as defined by FICO a score of 350 to 579 you wont be able to qualify for a personal loan unless you apply with a co-signer. Check Your Rate Learn more.

News And Articles First Exchange Bank North Central West Virginia

Can You Get A Heloc With A Bad Credit Score Credello

Home Equity Line Of Credit Heloc Rocket Mortgage

Homeowners Are Sitting On A Record 6 Trillion In Equity Why Aren T They Using It Home Equity Equity Line Of Credit

Bvalentinerealestate04 Posted To Instagram Owning A Home Comes With All Kinds Of Perks Like Getting A Loan To Help With Upgrade Heloc Home Equity Get A Loan

How A Home Equity Line Of Credit Heloc Can Affect Your Credit Score Liberty Bay Credit Union

Home Equity Line Of Credit Heloc Midland States Bank

Home Equity Line Of Credit Hickam Federal Credit Union

Find Your Home S Silver Lining With A Home Equity Line Of Credit Heloc As Low As 2 99 Apr Introductory Fixed Rate For 12 Home Equity Line Of Credit Heloc

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Park Bank Home Equity Ads On Behance Home Equity Equity Line Of Credit

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage